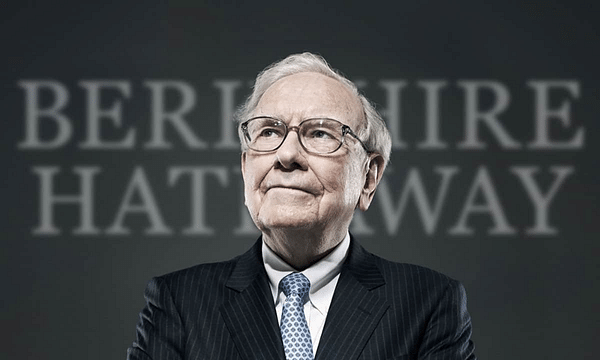

Moving to cash: Buffett's Berkshire cuts stock positions, sells mostly Apple

In the third quarter of 2024, Berkshire Hathaway, led by legendary investor Warren Buffett, significantly sold its stock holdings. The most notable move was the sale of 25% of its Apple stock, which contributed significantly to boosting the company's cash reserve to a record $325.2 billion. The move reflects Buffett's strategy, which currently favors a cautious approach to stock investments.

Berkshire Hathaway reduces stake in Apple

In a report Saturday, Berkshire Hathaway said it sold about 100 million shares of Apple $AAPLduring the summer months , bringing its stake down to 300 million shares. Still, Apple remains Berkshire Hathaway's largest stock investment at $69.9 billion. Despite this decline, Buffett has said in the past that Apple will likely continue to be a key part of Berkshire's investment portfolio, but the stock sale made sense given rising capital gains tax rates.

During the third quarter, Berkshire sold a total of $36.1 billion worth of stock, including several billion dollars of Bank of America $BACstock . Conversely, it purchased only $1.5 billion of stock, indicating a significant change in investment strategy, where for eight consecutive quarters Berkshire has been a net seller of stock.

Decline in operating profit and insurance losses

Berkshire Hathaway also reported a 6% decline in operating profit, the result of increased insurance costs due to higher claims and expenses associated with Hurricane Helene. Losses associated with the strengthening U.S. dollar also had a significant impact. Conversely, earnings increased in the GEICO and BNSF Railway divisions as insurance claims and operating expenses declined and consumer product traffic increased.

However, third-quarter underwriting profit fell 69%, the result not only of higher claims but also of $565 million in extraordinary losses from Hurricane Helene and the impact of the bankruptcy settlement with former talc supplier Whittaker Clark & Daniels. These declines offset a near doubling of underwriting profits at GEICO.

Future expectations and a cautious approach to the stock

Buffett has been of the view for several years that fluctuating market values of stocks should not have a major impact on judging Berkshire Hathaway's performance. However, under accounting rules, Berkshire is required to recognize unrealized gains and losses on investments when it discloses net income, which often causes significant swings in the company's net income. This volatility is something Buffett recommends investors ignore.

Despite the fluctuations in earnings, Berkshire maintains a strong position, reflecting not only the stability of its core divisions but also the careful strategy of Warren Buffett, who has been at the helm of the company since 1965. The financial magnate, now 94, plans to hand over the reins to his deputy, Greg Abel, to ensure the continuation of Berkshire Hathaway's conservative and long-term oriented investment philosophy.

Disclaimer: You will find a lot of inspiration on Bulios, but stock selection and portfolio construction is up to you, so always do your own thorough analysis.

Source.