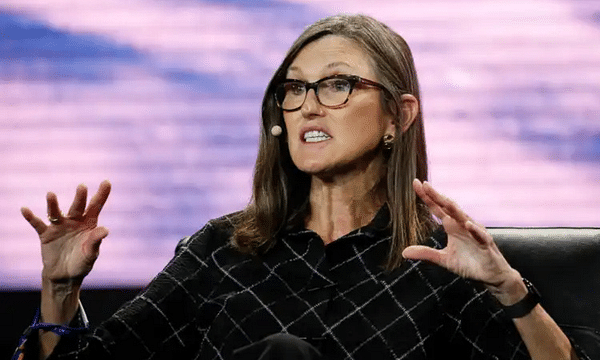

3 stocks that Cathie Wood is adding to its portfolio

Cathie Wood, well-known investor and founder of Ark Invest, still believes in the potential of her favorite tech stocks. Her growth-focused funds are starting to show positive results in 2024, although they are not yet outperforming the overall market. Despite these challenges, Wood continues to build on her existing positions, recently increasing her investments in 3 companies.

Despite the overall market uncertainty, Cathie Wood continues to believe that investing in innovative technology is key to achieving long-term growth. Its funds continue to focus on companies that represent the future and have the ability to revolutionise various industries. Which companies does it trust most at the moment?

Shopify $SHOP

Shares of Shopify, a Canadian e-commerce solutions provider, have risen more than 60% since this summer, and Wood has welcomed the rebound with another purchase. Shopify provides a platform for businesses to create and manage online stores, making it a key player in the digital commerce space. Shopify expects to report positive third-quarter results next week, and the latest financial results released suggest it has growth potential.

In the second quarter, Shopify reported 21% year-over-year revenue growth, significantly beating analysts' expectations. The company returned to profitability and free cash flow more than tripled. Despite a weaker May forecast, the company surprised positively. Wood believes Shopify will continue to benefit from the growing demand for online sales platforms, as evidenced by its willingness to invest just before the new results were announced.

Meta Platforms $META

Wood takes a slightly different approach to Meta, the operator of Facebook, Instagram and WhatsApp. Meta recently released its third-quarter results, which beat expectations, but ironically, the stock fell on Halloween due to concerns over rising costs. Despite this, Wood continues to invest in Meta, largely because of its large user base of more than 3.2 billion daily active users.

Meta posted a 19% year-over-year increase in revenue and its earnings per share rose 37%. Thus, Wood sees opportunity in the market's concerns because despite a slight slowdown in revenue growth, Meta has maintained an impressive growth rate that justifies its valuation.

Coinbase $COIN

In 2024, cryptocurrencies are back in the limelight, with Bitcoin's value increasing by over 60%. However, Coinbase, the largest trading platform for cryptocurrencies, has only seen its stock grow slightly by a few percent compared to Bitcoin's development. However, Wood continues to see great potential in Coinbase, especially with its connection to Bitcoin, which accounts for 37% of the platform's trading volume.

Coinbase recently announced that its revenue has nearly doubled, though the company continues to struggle for profitability. Although the last two quarterly results have fallen short of net profit expectations, Wood still believes in the long-term growth potential of cryptocurrencies and sees Coinbase as an ideal opportunity to participate in this trend.

Disclaimer: There is plenty of inspiration to be found on Bulios, but stock selection and portfolio construction is entirely up to you, so always conduct thorough self-analysis.

Source: Yahoo Finance.