Is COVID-19 a Threat to Global Growth in Autumn? China is the answer

The coronavirus pandemic has struck the optimistic markets in 2020, causing a major sell-off in aviation, sports, tourism and all other stocks which weren’t the ‘winners’ of COVID-19, AMPE FX reports.

Technology-intensive companies like $NFLX+0.3% , $AMZN-0.5% and $ZM-0.2% , and pharma giants including $PFE+0.9% and $MRNA-4.4% have all enjoyed a whopping 2020 as investors, just like consumers & businesses, flocked to their services amid shutdowns and high demand for remote work and operations.

Globally-trusted vaccines emerged and many economies have fully-recovered from the depths of the epidemic within six months. Nations fought long & hard for over six years to recuperate from the ill-famed financial crisis of 2008, so this marked a very commendable & timely recovery.

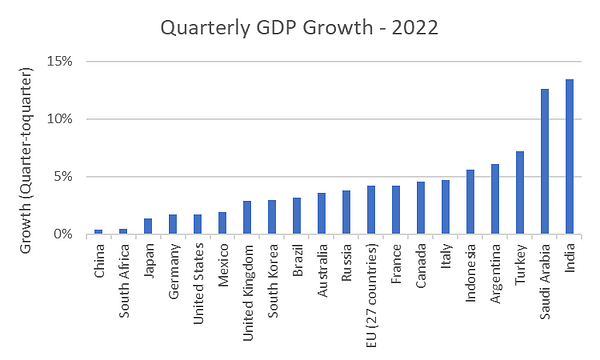

Not all nations bounced back from the lows of COVID. China was the first to open up and lift restrictions, but recurrent waves of new strains have sent the nation to oblivion. Hand-in-hand with poor domestic figures, Chinese markets are struggling to grow in the autumn of 2022.

China represents 18% of total global GDP, or $16.8 trillion. This is bad news for the global growth outlook, both in the short and long run. Currently, the Asian nation is a victim of a daunting reappearance of the coronavirus, prompting the revival of the stringent ‘COVID Zero’ initiative which led to low manufacturing and spending.

Youth unemployment is sky-high, supply chain bottlenecks are damaging production and the housing market is collapsing hard. If domestic conditions continue to worsen, global macroeconomic growth may take a halt. [1]

The autumn season of 2022 presents mounting worries to say the least. Uncertainty is at levels unwitnessed before, as central banks push interest rate higher to tame inflation, macropolitical issues continue to loom, and global markets have no clear short nor long-term direction.

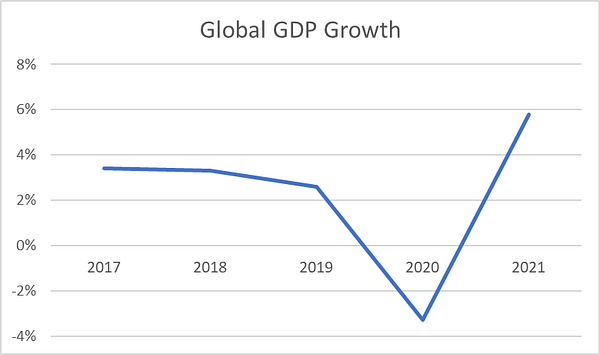

The International Monetary Fund (IMF) expects GDP growth to slow to 3.2% in 2022, but much depends on macropolitical conditions and how nations respond to COVID-19 damages and contemporary inflationary pressures. [2]

Source: The World Bank

How COVID-19 has impacted economic growth

Flashback to autumn of 2020, economies were in despair. Countries across all continents were reporting new cases of the infamous virus, and the number of infections was increasing by the day. There was no global GDP (Gross Domestic Product) growth in 2020, but rather the opposite. GDP shrunk by 3.3% in 2020, but 2021 bestowed some ease.

In autumn of 2021, despite the resurgence of the virus and its numerous variants, global GDP expanded by 5.8% for the year according to The World Bank. The S&P 500 index, which accurately represents the macroeconomy, portrays that economies reawakened in six months as restrictions & measures remained active.

Source: The World Bank

Peter Svoreň

Executive Director

APME FX TRADING EUROPE LTD

Risk warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 86.36% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

[1,2] Forward-looking statements are based on assumptions and current expectations, which may be inaccurate, or based on the current economic environment which is subject to change. Such statements are not guaranteeing of future performance. They involve risks and other uncertainties which are difficult to predict. Results could differ materially from those expressed or implied in any forward-looking statements.

I think that we will see very soon...

It will be interesting in my opinion