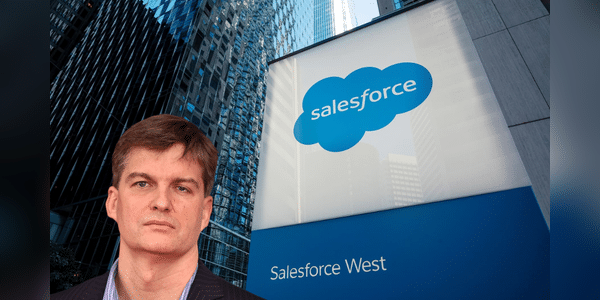

This company is disgustingly and ridiculously overpriced, the legendary Michael Burry lashed out at the software giant

Burry's on the rampage again. For several years they have been talking repeatedly about the exorbitant prices of the whole sector or even the market. But this time he has taken on a particular company! Who does he blame for the exorbitant price?

Burry has often made public comments to the effect that the entire market is still not right and is marked by a long period of prosperity and ill-advised retail investments. That has changed a bit recently as the markets have been awash in the blood of overpriced tech stocks and unsophisticated investors. But despite that, Burry still thinks some companies aren't fairly valued at all - Salesforce $CRM, for example.

In an effort to cut costs, the company has resorted to massive layoffs, shrinking office space, and exiting some real estate markets. Salesforce said the layoffs and broader restructuring plans will cost $1.4…

https://vk.com/@zip_movie-2023-hd-1080p

https://vk.com/@zip_movie-2023-hd4k-1080p

https://vk.com/@zip_movie-4-2023-hd-thai

https://vk.com/@zip_movie-4-2023-john-wick-chapter-4

https://vk.com/@zip_movie-xem-phim-sat-thu-john-wick-chuong-4-2022-full-hd-vietsub-mie

https://vk.com/@zip_movie-il-genio-dello-film-john-wick-chapter-4-gratis-streaming-ita

https://vk.com/@zip_movie-2023

https://vk.com/@zip_movie-2023-1080p-hd

https://vk.com/@zip_movie-zeft1983-2023-hd-1080p

https://vk.com/@zip_movie-2-1080-2022-tw

https://vk.com/@zip_movie-4-john-wick-chapter-4-2023-hd-1080p-twhk

https://vk.com/@zip_movie-filmsvoir-avatar-2-la-voie-de-leau-2022-francais-gratuit-et

https://vk.com/@zip_movie-filmsvoir-avatar-2-la-voie-de-leau-2022-francais-gratuit-et

https://vk.com/@zip_movie-avatar-the-way-of-water2022-4k

https://vk.com/@zip_movie-2022-1080phttps://anotepad.com/notes/6iybbf34

https://anotepad.com/notes/6iybbf34

https://anotepad.com/notes/dgi7xwq5

https://linkbio.co/5040116KNA5gp

https://linkbio.co/5040116c5C4RK

vk.com/@zip_movie-2023-hd-1080p

vk.com/@zip_movie-2023-hd4k-1080p

vk.com/@zip_movie-4-2023-hd-thai

vk.com/@zip_movie-4-2023-john-wick-chapter-4

vk.com/@zip_movie-xem-phim-sat-thu-john-wick-chuong-4-2022-full-hd-vietsub-mie

vk.com/@zip_movie-il-genio-dello-film-john-wick-chapter-4-gratis-streaming-ita

vk.com/@zip_movie-2023

vk.com/@zip_movie-2023-1080p-hd

vk.com/@zip_movie-zeft1983-2023-hd-1080p

vk.com/@zip_movie-2-1080-2022-tw

vk.com/@zip_movie-4-john-wick-chapter-4-2023-hd-1080p-twhk

vk.com/@zip_movie-filmsvoir-avatar-2-la-voie-de-leau-2022-francais-gratuit-et

https://vk.com/@zip_movie-filmsvoir-avatar-2-la-voie-de-leau-2022-francais-gratuit-et

vk.com/@zip_movie-avatar-the-way-of-water2022-4k

vk.com/@zip_movie-2022-1080phttps://anotepad.com/notes/6iybbf34

https://anotepad.com/notes/6iybbf34

https://anotepad.com/notes/dgi7xwq5

https://linkbio.co/5040116KNA5gp

https://linkbio.co/5040116c5C4RK

https://vk.com/@zip_movie-2023-hd-1080p

https://vk.com/@zip_movie-2023-hd4k-1080p

https://vk.com/@zip_movie-4-2023-hd-thai

https://vk.com/@zip_movie-4-2023-john-wick-chapter-4

https://vk.com/@zip_movie-xem-phim-sat-thu-john-wick-chuong-4-2022-full-hd-vietsub-mie

https://vk.com/@zip_movie-il-genio-dello-film-john-wick-chapter-4-gratis-streaming-ita

https://vk.com/@zip_movie-2023

https://vk.com/@zip_movie-2023-1080p-hd

https://vk.com/@zip_movie-zeft1983-2023-hd-1080p

https://vk.com/@zip_movie-2-1080-2022-tw

https://vk.com/@zip_movie-4-john-wick-chapter-4-2023-hd-1080p-twhk

https://vk.com/@zip_movie-filmsvoir-avatar-2-la-voie-de-leau-2022-francais-gratuit-et

https://vk.com/@zip_movie-2023-hd-1080p

https://vk.com/@zip_movie-2023-hd4k-1080p

https://vk.com/@zip_movie-4-2023-hd-thai

https://vk.com/@zip_movie-4-2023-john-wick-chapter-4

https://vk.com/@zip_movie-xem-phim-sat-thu-john-wick-chuong-4-2022-full-hd-vietsub-mie

https://vk.com/@zip_movie-il-genio-dello-film-john-wick-chapter-4-gratis-streaming-ita

https://vk.com/@zip_movie-2023

https://vk.com/@zip_movie-2023-1080p-hd

https://vk.com/@zip_movie-zeft1983-2023-hd-1080p

https://vk.com/@zip_movie-2-1080-2022-tw

https://vk.com/@zip_movie-4-john-wick-chapter-4-2023-hd-1080p-twhk

https://vk.com/@zip_movie-filmsvoir-avatar-2-la-voie-de-leau-2022-francais-gratuit-et

https://vk.com/@zip_movie-filmsvoir-avatar-2-la-voie-de-leau-2022-francais-gratuit-et

https://vk.com/@zip_movie-avatar-the-way-of-water2022-4k

https://vk.com/@zip_movie-2022-1080phttps://anotepad.com/notes/6iybbf34

https://anotepad.com/notes/6iybbf34

https://anotepad.com/notes/dgi7xwq5

https://linkbio.co/5040116KNA5gp

https://linkbio.co/5040116c5C4RK

vk.com/@zip_movie-2023-hd-1080p

vk.com/@zip_movie-2023-hd4k-1080p

vk.com/@zip_movie-4-2023-hd-thai

vk.com/@zip_movie-4-2023-john-wick-chapter-4

vk.com/@zip_movie-xem-phim-sat-thu-john-wick-chuong-4-2022-full-hd-vietsub-mie

vk.com/@zip_movie-il-genio-dello-film-john-wick-chapter-4-gratis-streaming-ita

vk.com/@zip_movie-2023

vk.com/@zip_movie-2023-1080p-hd

vk.com/@zip_movie-zeft1983-2023-hd-1080p

vk.com/@zip_movie-2-1080-2022-tw

vk.com/@zip_movie-4-john-wick-chapter-4-2023-hd-1080p-twhk

vk.com/@zip_movie-filmsvoir-avatar-2-la-voie-de-leau-2022-francais-gratuit-et

https://vk.com/@zip_movie-filmsvoir-avatar-2-la-voie-de-leau-2022-francais-gratuit-et

vk.com/@zip_movie-avatar-the-way-of-water2022-4k

vk.com/@zip_movie-2022-1080phttps://anotepad.com/notes/6iybbf34

https://anotepad.com/notes/6iybbf34

https://anotepad.com/notes/dgi7xwq5

https://linkbio.co/5040116KNA5gp

https://linkbio.co/5040116c5C4RK

https://vk.com/@zip_movie-2023-hd-1080p

https://vk.com/@zip_movie-2023-hd4k-1080p

https://vk.com/@zip_movie-4-2023-hd-thai

https://vk.com/@zip_movie-4-2023-john-wick-chapter-4

https://vk.com/@zip_movie-xem-phim-sat-thu-john-wick-chuong-4-2022-full-hd-vietsub-mie

https://vk.com/@zip_movie-il-genio-dello-film-john-wick-chapter-4-gratis-streaming-ita

https://vk.com/@zip_movie-2023

https://vk.com/@zip_movie-2023-1080p-hd

https://vk.com/@zip_movie-zeft1983-2023-hd-1080p

https://vk.com/@zip_movie-2-1080-2022-tw

https://vk.com/@zip_movie-4-john-wick-chapter-4-2023-hd-1080p-twhk

https://vk.com/@zip_movie-filmsvoir-avatar-2-la-voie-de-leau-2022-francais-gratuit-et

Almost most important is what the Federal Reserve does. The U.S. Federal Reserve is tasked with not only keeping unemployment low, but also keeping prices in check throughout the economy.

good

https://www.scoop.it/topic/ant-man-and-the-wasp-quantumania-2022-stream-deutsch-kostenlos-hd-1080phttps://www.scoop.it/topic/stream-hd-ant-man-and-the-wasp-quantumania-2023-ganzer-film-deutschhttps://www.scoop.it/topic/streamcloud-ant-man-and-the-wasp-quantumania-2023-stream-deutsch-kostenloshttps://www.scoop.it/topic/guarda-ant-man-3-streaming-ita-in-altadefinizione-2023https://www.scoop.it/topic/viooz-ant-man-3-streaming-ita-altadefinizionehttps://www.scoop.it/topic/viooz-asterix-obelix-il-regno-di-mezzo-streaming-ita-altadefinizionehttps://www.scoop.it/topic/guarda-cb01-asterix-obelix-il-regno-di-mezzo-streaming-ita-in-altadefinizione-2023https://www.scoop.it/topic/altadefinizione-asterix-obelix-il-regno-di-mezzo-film-streaming-sub-ita-hdhttps://r2.community.samsung.com/t5/Community-Guidelines/STREAMCLOUD-Ant-Man-and-the-Wasp-Quantumania-2022-Ganzer-film/td-p/13307563https://dovevedereasterixobelixilregnodimezzo2023streamingitalino.statuspage.io/https://www.flowcode.com/page/antman3-streamingitahttps://www.flowcode.com/page/streamingasterixobelix-gratishttps://www.podcasts.com/gratis-altadefinizione-hd-ita-2022/episode/guarda-asterix-obelix-il-regno-di-mezzo-2022-film-completo-ita-streaming-in-altadefinizione

very nice post

https://bulios.com/status/83355-avatar-2-the-way-of-water-2023-fullmovie-online-streaming-for-free-at-homehttps://bulios.com/status/83356-avatar-2-the-way-of-water-2022-yts-torrent-download-yify-movieshttps://bulios.com/status/83357-avatar-2-the-way-of-water-2022-fullmovie-free-online-on-123movieshttps://bulios.com/status/83358-watch-avatar-2-the-way-of-water-2022-fullmovie-free-online-on-123movieshttps://bulios.com/status/83354-download-avatar-2-the-way-of-water-2022-full-movie-download-free-720p-480p-and-1080p

https://bulios.com/status/83359-watch-m3gan-2022-fullmovie-free-online-on-123movieshttps://bulios.com/status/83360-m3gan-2022-yts-torrent-download-yify-moviehttps://bulios.com/status/83361-m3gan-2023-fullmovie-online-streaming-for-free-at-homehttps://bulios.com/status/83362-m3gan-2022-fullmovie-free-online-on-123movieshttps://bulios.com/status/83363-download-m3gan-2022-full-movie-download-free-720p-480p-and-1080p

https://bulios.com/status/83364-the-legend-of-maula-jatt-2022-yts-torrent-download-yify-moviehttps://bulios.com/status/83365-watch-the-legend-of-maula-jatt-2022-fullmovie-free-online-on-123movieshttps://bulios.com/status/83366-the-legend-of-maula-jatt-2023-fullmovie-online-streaming-for-free-at-homehttps://bulios.com/status/83367-the-legend-of-maula-jatt-2022-fullmovie-free-online-on-123movieshttps://bulios.com/status/83368-official-watch-the-legend-of-maula-jatt-full-movies-online-for-free

https://bulios.com/status/83369-babylon-2022-yts-torrent-download-yify-moviehttps://bulios.com/status/83370-watch-babylon-2022-fullmovie-free-online-on-123movieshttps://bulios.com/status/83371-babylon-2023-fullmovie-online-streaming-for-free-at-homehttps://bulios.com/status/83372-babylon-2022-fullmovie-free-online-on-123movieshttps://bulios.com/status/83373-download-babylon-2022-full-movie-torrent-download-free-720p-480p-and-1080p

https://bulios.com/status/83374-download-pathaan-2022-full-movie-torrent-download-free-720p-480p-and-1080phttps://bulios.com/status/83375-pathaan-2022-fullmovie-free-online-on-123movieshttps://bulios.com/status/83376-pathaan-2022-yts-torrent-download-yify-movieshttps://bulios.com/status/83377-pathaan-2023-fullmovie-online-streaming-for-free-at-homehttps://bulios.com/status/83378-watch-pathaan-2022-fullmovie-free-online-on-123movies

https://events.ydr.com/event/582f22dd5cde86196591ccd7379b3f2ahttps://events.ydr.com/event/573341f4113336a527af765f08463ebehttps://events.ydr.com/event/356d50ea9c09dff5d88c6c6fdefa586chttps://events.ydr.com/event/c066c2529f223ea4cff6f63314f78ee5https://events.ydr.com/event/0865b749a930290be16a9ff1cf85c69bhttps://events.ydr.com/event/f31348ee5633c663265b8816351a5489https://events.ydr.com/event/69b5a43617fb3a889827b440a4d047bbhttps://events.ydr.com/event/72d1ef690f0d0b66a35aa7b45774367chttps://events.ydr.com/event/5977affb36183b91f68bfb51b84b81dchttps://events.ydr.com/event/52ebad4abd13a616d6f06ea30324bf6b

https://communityin.oppo.com/thread/1257102198744809477https://communityin.oppo.com/thread/1257103344284467203https://communityin.oppo.com/thread/1257103372436635653https://communityin.oppo.com/thread/1257103395740188676https://communityin.oppo.com/thread/1257103417709953026

https://communityin.oppo.com/thread/1257033504483966982https://communityin.oppo.com/thread/1257033538994700292https://communityin.oppo.com/thread/1257033611170545669https://communityin.oppo.com/thread/1257033634935472129https://communityin.oppo.com/thread/1257033653390409734

https://www.scoop.it/topic/regardez-babylon-vf-fr-film-complet-gratuit-francaishttps://www.scoop.it/topic/voir-asterix-obelix-l-empire-du-milieu-streaming-vf-gratuit-fr-complet-entier-francais-vostfr-by-tifig-chaknanhttps://www.scoop.it/topic/guarda-me-contro-te-il-film-missione-giungla-streaming-ita-in-altadefinizione-2023-by-nonane-wjpyohttps://www.scoop.it/topic/openload-babylon-streaming-ita-senza-limiti-by-lajopo-babbdhttps://www.scoop.it/topic/guarda-film-avatar-2-streaming-ita-in-altadefinizione-2023https://www.flowcode.com/page/voirfilmasterixobelixgratisshttps://www.podcasts.com/babylon-1/episode/regardez-babylon-vf-fr-filmhttps://dovevederemecontroteilfilmmissionegiunglastreamingitalino.statuspage.io/https://cbo1babylonstreamingitasenzalimitigratis.statuspage.io/

wow

follow me