Anthony Scaramucci: The bear market is over! If I were you, I'd be buying stocks immediately. Don't let this opportunity pass you by, history clearly shows us what to expect next.

Anthony Scaramucci is a popular American financier who works at SkyBridge Capital, and who also briefly served as White House Communications Director in the past.

Scaramucci highlights the stock market's bullish signal that suggests the bear market is finally over 👇

The stock market could be on the verge of ending the bear market for good after the S&P 500 has traded above its 200-day moving average for 20 consecutive trading days just above the technical level being watched.

🚨 No previous bear market in the S&P 500 in history has reached a new low after closing above its 200-day moving average 20 consecutive times," Scaramucci wrote on Twitter.🚨

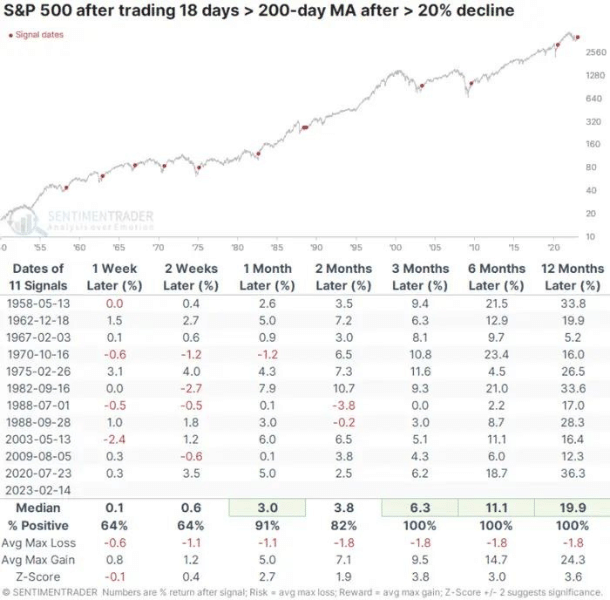

Based on an analysis of historical data, he might not be wrong at all 👇

Looking at the S&P 500 index since 1950, the following parameters were used: that the index has seen more than a 20% decline (meaning it is in a bear market) and that the index has then traded above its 200-day moving average for 18 or more consecutive days.

Of the 11 times this scenario has occurred, the following has happened:

- In all cases, the S&P 500 Index traded higher by three, six and 12 months with median gains of 6.3%, 11.1% and 19.9%, respectively.

- The S&P 500 Index was higher 91% of the time after one month.

- The S&P 500 Index never reached new lows or tested its bearish low. In other words, the index has historically never looked back after this signal was recorded.

The previous times the S&P 500 generated this bullish signal were July 2020, August 2009 and May 2003, all dates that ultimately proved to be good times to buy stocks.

This time could be different, of course, as investors worry about high inflation, rising interest rates and a potential recession. But history suggests that the worst stock market weakness in a year could be behind us.

Conclusion

Personally, I wouldn't rely on past scenarios, although they sound good enough, you can't compare current market, economic and global conditions with those of the past. Of course I could be wrong, it is just my opinion and I may be missing an opportunity at the moment, however I will give my opinion and stick to the strategy I have set.

- How do you see it?

Please note that this is not financial advice. Every investment must go through a thorough analysis.