Now, you may be wondering what the formula has to do with Splunk, the company we're going to talk about today. Actually, there is quite a lot, namely their technology and software, which is used and praised by McLaren itself and other well-known companies.

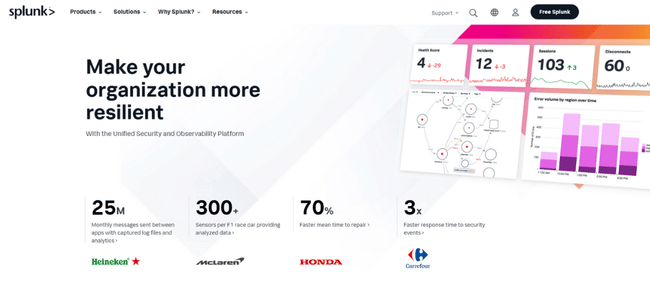

Splunk $SPLK specializes in big data management and analysis software called Splunk Enterprise. This software allows organizations to collect, analyze, and visualize data from a variety of sources, including web servers, applications, networks, cloud environments, and more.

Splunk Enterprise provides users with the ability to search, monitor, and analyze data in real-time using an intuitive user interface and robust data discovery, filtering, and visualization tools. The software is used for many different purposes, including security monitoring, IT infrastructure management, application and service management, and more.

Splunk also offers a number of other products and services, such as Splunk Cloud, Splunk IT Service Intelligence, Splunk Enterprise Security, and Splunk User Behavior Analytics. These products and services provide enhanced features and capabilities so organizations can better understand their data and use it to achieve better results.

Customers of interest include Heineken, McLaren and Honda

Splunk is used by world-renowned companies 👇

Heineken

Heineken distributes nearly 50 billion liters (13 billion gallons) of beer each year to urban metropolises and remote destinations around the world - and every bottle must be of the same high quality. Meeting these expectations on such a huge scale requires fine-tuned precision in all of Heineken's processes, from the barley field to the bottling line to the bar top.

To keep everything in the brewing, supply chain and financial processes running smoothly and continuously, Heineken relies on the Splunk platform to provide visibility into these extensive systems.

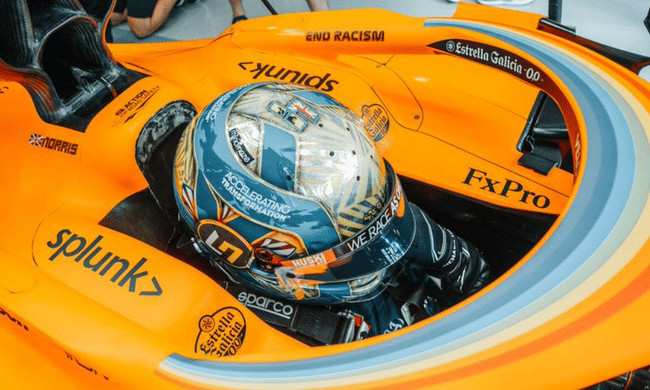

McLaren

By using Splunk to convert real-time data into actionable insights, McLaren is increasing its competitive advantage and accelerating the pace of development in Formula 1 and esports racing.

In the world of F1, data can be the difference between a good race and an expensive defeat. And McLaren management knows this all too well 👇

"Splunk is very important to our performance both on and off the track. You have to have both because if we are not competitive off the track, we will not be competitive on the track."

Honda

"Splunk allows us to act on [our] data, provide information, answer questions, and solve problems we may not have even known we had."

How does Splunk have a large market share?

According to various research and analysis, Splunk is considered one of the leaders in data management and analytics.

In 2020, Splunk was ranked 6th on Gartner's list of the world's largest software application and service providers by revenue. Splunk has also received numerous awards and recognition for its products and services, including the Leader in Information Security and Event Management award in Gartner's Magic Quadrant survey.

Splunk also has a large customer base that includes thousands of companies in a variety of industries, including financial services, technology, healthcare, government and more. This shows that Splunk has a large presence in the market and that its products and services are in high demand and use.

What do they actually derive their revenue from?

Splunk's revenue for fiscal year 2022 (ending January 31, 2022) was divided into:

- Cloud revenue (35% of total revenue)

- Licensing revenue (38% of total revenue)

- Maintenance and services revenue (27% of total revenue)

Splunk also earns money from subscriptions to its cloud and software products, which allow customers to collect, analyze and use data from a variety of sources.

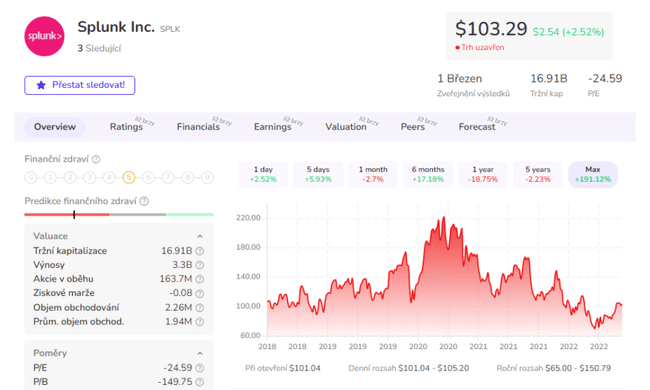

Finance

Revenue

Looking at the last 5 years, we can see that the company reported revenue of $1.27 billion in 2017, growing to $2.67 billion in 2022, an average of 24% per year.

Net Profits

However, net profits have been widening their loss over the past 5 years and as of 2022, the net loss was $1.34 billion.

But I should note here that the company reported positive net income of $269 million, or $1.44 per share, in the fourth quarter of 2022, compared to a loss of $140.8 million, or 88 cents per share, in the year-ago period, so there is some indication of improvement.

The reasons for the increase in losses are simple:

- A couple of years ago, there was a shift to a cloud-based subscription model that reduces short-term revenue and margins, which should stabilize over time.

- Increased competition in the data analytics and security market.

- Recent management change.

Splunk began transitioning to a cloud-based subscription model in 2017 and completed the process in 2020. This transition resulted in a reduction in the company's short-term revenue and margins, but an increase in recurring revenue and long-term customer value.

Assets x Liabilities

Splunk had total assets of $3.9 billion and total liabilities of $4.5 billion in 2022.

Long-term debt

Splunk's long-term debt in 2022 was $3.138 billion, up 36.27% from 2021.

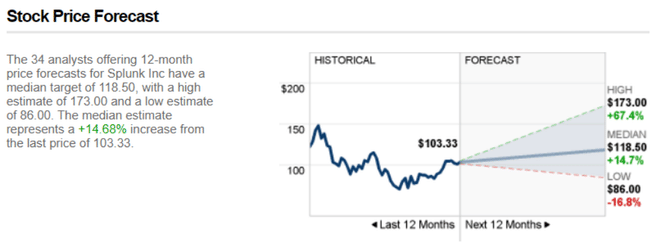

However, analysts are confident in the company and most of them cover SPLK stock with a buy rating and recommend holding the rest. This is because the general expectation is that things will stabilize after the transition to the cloud model and we will see better numbers + utilization soon.

Personally, I like the company's focus a lot and the promising clientele that praises Splunk's services. It's hard to predict when the company will recover from the transition to the cloud subscription model and start to be profitable, but for me personally it's an interesting piece that I'll put on my watchlist at the very least.

Please note that this is not a financial advisory. Every investment must go through a thorough analysis.