Analysis of GeoPark Limited: Dividend policy comes first

GeoPark Limited may be an unfamiliar company to many, but it is a very interesting oil and gas producer that is focused on rewarding shareholders with an attractive dividend, which it intends to continue to increase.

What does the company do?

GeoPark Limited $GPRK is an international company headquartered in Hong Kong that is involved in oil and gas exploration, as well as renewable energy and geothermal energy. The company was founded in 2002 and operates projects in Latin America (mainly in Chile, Colombia, Brazil and Argentina), Asia (mainly in Indonesia and Thailand) and Europe (mainly in Spain). The company is one of the largest oil and gas producers in Latin America.

Geopark Limited is also committed to environmental protection and sustainable development, which is in line with its objectives to promote sustainable tourism and environmental education. Geopark Limited invests in renewable energy and geothermal energy to reduce dependence on fossil fuels and promote sustainable development.

Geopark Limited also operates several oil and gas projects that are based on modern technologies and methods that minimise environmental impact. The company seeks to work with local communities and suppliers to support the social and economic development of the regions where it operates.

Geopark Limited has several competitive advantages:

- The Company has a team of geology and geophysics experts who have many years of experience in oil and gas exploration and production. This enables the company to identify and apply the best geological and geophysical technologies to its projects.

- Geopark Limited also has a diversified portfolio of projects in different regions of the world, which means the company is less dependent on any one market or project. This helps to reduce risk and increase revenue stability.

- The company also uses modern technology and innovative practices that increase mining efficiency and reduce costs. The Company also strives to optimize its processes and costs and leverages synergies between projects.

Risks

Risks associated with oil and gas prices: Geopark Limited is an oil and gas producing company, which means that it is dependent on the prices of these commodities. A decline in oil and gas prices may have a negative impact on the company's performance and profitability.

Risks associated with geological conditions: oil and gas exploration and production are activities that are dependent on geological conditions. Exploration results may be lower than expected, which could lead to a reduction in the Company's production and profitability.

Risks associated with political and economic instability: Geopark Limited operates in several countries where it may be exposed to political and economic instability. This may include changes in legislation, government intervention and other risks associated with international trade.

Finance

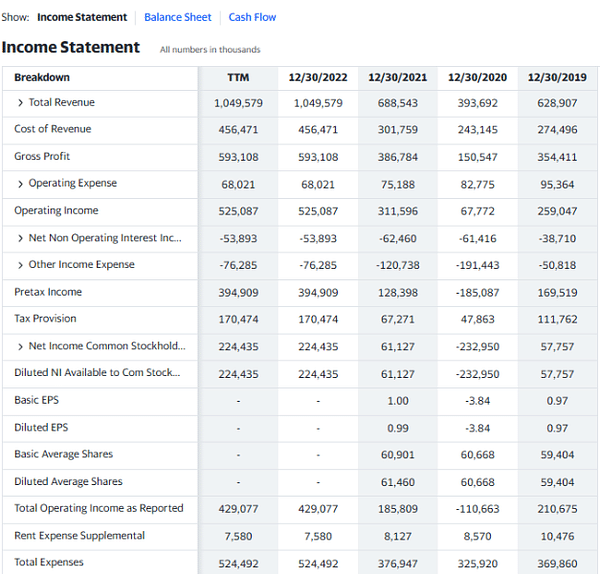

The company has seen significant revenue growth since 2019, when revenue was 393mil. This has gone hand-in-hand with profitability, which has risen sharply over the period, to over US$1bn in the last twelve months.

In addition, the company appears to be maintaining low operating costs, which have remained relatively stable over the past few years. This, together with a significant increase in gross profit, has led to a significant increase in operating profit.

Overall, the company has seen significant growth in sales and profitability, indicating that the company has performed well over the past few years.

Cash Flow

Overall, the company has generated positive operating cash flow and free cash flow during 2022, indicating that it is generating sufficient cash flow from its operations and has some cash remaining after accounting for capital investments, which is good to know.

However, the company had negative investing cash flow and financing cash flow, indicating that it is investing more than it generates from its investing activities and spending more than it generates from its financing activities.

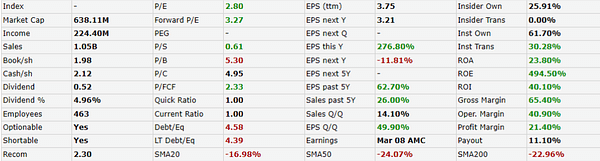

- The company has a low P/E ratio of 2.80 as well as Forward P/E, indicating that the stock is relatively cheap compared to its earnings.

- Insider Own is at 25.91%, indicating that a significant percentage of the company is owned by insiders.

What's really fascinating are their huge ROE, ROA and ROI, but the same can be said for their margins, which are at a relatively high level.

Overall, the company seems to have strong financials with high earnings, revenue and ROE. However, the negative PEG ratio and high beta may indicate that the stock is not expected to grow in the future and may be more volatile than the overall market.

- Unfortunately, the D/E ratio here is too high for me, which is discouraging despite the impressive metrics and returns.

What about the dividend?

GeoPark Limited has paid a regular dividend since 2011 and has increased the dividend every year for the past 5 years, with the dividend currently at 4.96%.

The Company's dividend policy targets a sustainable rate of dividend growth in line with long-term profitability growth. The company's management has an ambition to continue to pay out 25-50% of net profit in the form of dividends in the future, which should be sustainable.

How do analysts see it?

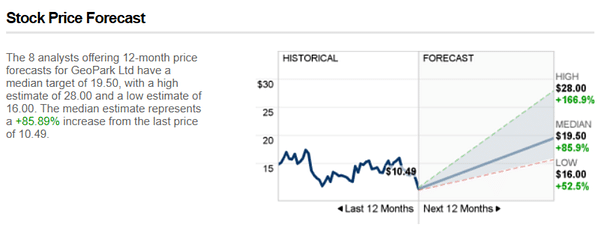

The 8 analysts offering 12-month price forecasts for GeoPark Ltd have a median target of 19.50, with a high estimate of 28.00 and a low estimate of 16.00. The median estimate represents an increase of +85.89% from the last price of 10.49.

- How do you like the company? 🤔

Please note that this is not financial advice. Every investment must go through a thorough analysis.