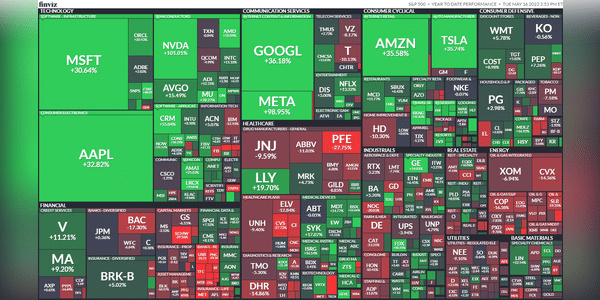

Konečně vidíme nějaký pokles u akcií jako $MCD $PEP $PG $KO a přidal se i $SBUX myslím, že ten pokles nekončí a tak konečně ti co jsou tu nově budou mít možnost přikoupit tyhle dobré akcie aspoň za nějakou první pozici co případně mohou ředit dále.. :) Jen škoda že se k tomu ještě nepřidali $MSFT a $GOOG ti naopak rostou do nebes... :)

Feed

Bulios Black

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Zobrazit další komentáře

Bulios Black

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

To ano, tento rok je lepší díky těmto společnostem, bohužel mi ten zisk i kazi trochu ztrátové pozice mimo technologicky sektor. Měl jsem $NVDA a $AMZN , už nemám, bral jsem zisk. Poučil se, jelikož měl jsem si to nechat, měl bych pak více. 😃 Tudíž stále držím v zeleném $AAPL $MSFT $GOOG $META 💰🍀 Takže klasika jako asi většina

Bulios Black

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Tak je to oficiální, největší videoherní akvizice $ATVI technologickým gigantem $MSFT má zelenou od regulačních úřadů EU. Microsoft se podle mě odvolá na zamítnutí britským regulačním úřadem. Už se zdá, že se tato "válka" s úřady blíží ke konci. Co si o tomto obchodu myslíte?

Zobrazit další komentáře

Tohle jsou za mě tak obrovské události, že jejich následky budeme moct zhodnotit až za spousty let... takže z mého pohledu nebudou mít žádný zásadní dopad na cenu, která je tady a teď... a pokud náhodou ano, tak bych zrovna u těchto dvou firem neřekl, že pozitivní :) viz. Blizzard a jejich HR kauzy se zaměstnanci...

Bulios Black

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Zahrajeme si hru! Postav si dividendové impérium. 🤑🤑🤑

Dividendové impérium je koncept investování, který se zaměřuje na budování portfolia akcií společností, které pravidelně vyplácejí dividendy svým akcionářům. Tato strategie klade důraz na pasivní příjmy získávané z dividendových výplat, které mohou sloužit jako stabilní zdroj příjmů pro investory.

Kterých 5 společností bude ve...

Zobrazit více

Zobrazit další komentáře

Za mě $MSFT $MCD $JNJ $MMM $HD by nebylo úplně špatně... Ano místo MSFT se může hodit Apple ale já to bral i do budoucna skrz to že MSFT bude dost velký hráč s AI a o Apple zatím nevíme nic skrz AI... Takže výhodu mě dává spíš MSFT.. :) Z pohledu dividend to samozřejmě nebude kdo ví jaké procento a výdělek, ale zase je to i dost defenzivní je to defakto od každého sektoru trochu... :)

Bulios Black

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Evropská komise nejspíš schválí akvizici video herního giganta $ATVI technologickou společností $MSFT . Jednalo by se o největší akvizici v oboru videoher, Microsoft by za ní měl zaplatit 69 miliard dolarů.

Uvidíme, jak to bude pokračovat, ale nečekal jsem, že se to bude táhnout tak dlouho.

Zobrazit další komentáře

Blizzardu už být hůř nemůže... jen si nejsem jistý, zda-li ho zachrání zrovna Microsoft... :)

Bulios Black

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Portfolio

Když je ten víkend a nic se neděje.

Zajímalo by mě jaké jsou vaše nejoblíbenější akcie a případně na jaké akcii máte největší pozici.

Také bych se chtěl zeptat kolik % vašeho akciového portfolia tvoří hotovost.

Mě osobně se...

Zobrazit více

Bulios Black

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Máme víkend, tak si pojďme dát něco na odlehčení.👍

Představte si, že máte 1 milion korun, a můžete koupit pouze akcie, které začínají na první písmeno vašeho jména. Které byste koupili?🤔

Zobrazit další komentáře

Bulios Black

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Bulios Black

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Britský antimonopolní úřad zablokoval společnosti $MSFT převzetí videoherního giganta $ATVI . Transakce měla Microsoft přijít na zhruba 69 miliard dolarů. Activision Blizzard stojí za herními tituly jako jsou Call of Duty, World...

Zobrazit více

Zobrazit další komentáře

Zase je tu krasne videt prehnana reakce trhu. Tohle jeste neznamena, ze ta dohoda nemuze dopadnout. Je to vyjadreni jednoho z regulatoru a MSFT se proti nemu odvola. Stejne jako kdyz na nej FTC podalo zalobu, tak se nedavno firma vyjadrila, ze tu dohodu stejne protlaci.

Dalsi vec je, ze tu mame ohodnoceni akcie na 95usd (hodnoty z roku 2021) a neni duvod si myslet, proc by to aktualne melo byt mene. Kdo prodava jen kvuli tomu, ze se nedocka brzke vyplaty v tomto roce muze treba za rok docela litovat (leda by ty penize zhodnotil lepe nekde jinde;)

Bulios Black

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

jak se zatím koukáte na výsledkovou sezónu ???

Překvapila vás zatím mile/nemile nějaká společnost.

Případně můžete napsat jestli jste něco dokupovali.

Mě zatím mile překvapil $PG, $KO a ze včera mě ještě mile potěšil $MSFT a $GOOGL.

O...

Zobrazit více

Zobrazit další komentáře

Bulios Black

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Super grafika, tak se mi to líbí! 😁 Svým způsobem je největší šok asi FRC, přestože jsem neočekával nic pozitivního, tak ten propad byl opět brutální.

Bulios Black

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Microsoft $MSFT po výsledcích pořádně posílil!

Včera v aftermarketu akcie rostly až o 9%. Výsledky se podařilo překonat na všech frontách a oznámení, že umělá inteligence bude důležitou složkou příjmů firmy do konce roku to nakopla ještě víc.

Dnes se akcie zatím pěkně drží (+7.5%). Uvidíme, jak si trh povede po otevření, ale osobně bych čekal korekci.

$GOOG naopak posiloval místy...

Zobrazit více

Zobrazit další komentáře

Bulios Black

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Taky na to ted koukám, celkem solidní růst v segmentu cloud. Akorát to s takovou zkrátka levně nepřikoupím :D

Bulios Black

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

$GOOGL se snaží patentovat AI, která vám umožní vytvářet uživatelská rozhraní a dokonce i celé aplikace jen pomocí popisu v přirozeném jazyce. 💡🌐 Tento patent by mohl být pro $GOOGL další výhodou. 👍

...Zobrazit více

Zobrazit další komentáře

Bulios Black

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

já věděl že jednou budu programátor :D teda zapisovač do AI :D

Bulios Black

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

MSFT vs GOOGL

Zítra reportují svoje výsledky dvě velké technologické firmy a to $MSFT a $GOOGL. Myslím že většinu z nás ty výsledky zajímají.

Obě dvě společnosti zaplatily za obrovské náklady do vývoje umělé inteligence, a svých chatbotů. Což se určitě propíše ve výsledcích, které reportují zítra a myslím že by to mohlo být celkově zajímavé, a mohlo by případně dojít k nějakým...

Zobrazit více

Zobrazit další komentáře

No MSFT nám trošku klesá tak možná nervozita 😁 snad budeme pokračovat no nečekám Dump ale aspoň nějaký jednotky procent by mohl přidat no 🙏 pokud ty výsledky nebudou nějak extra dobré možná to dělá i ta zpráva o Google patentu no 🤔

Bulios Black

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Příští týden nám na trzích vypukne výsledková sezóna v pravém slova smyslu.

Těším se na technologické akcie, které bývají v tomto období velmi volatilní a chystám se provést pár tradů.

Určitě se moje pozornost bude upínat k výsledkům $GOOG a $MSFT . Především mě ale bude zajímat $META , která od posledních kvartálních výsledků, kdy se propadlo zhruba o 20% pěkně vyrostla....

Zobrazit více

Zobrazit další komentáře

Bulios Black

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Akcie Meta sice v portfoliu nemám, ale pravidelně jejich reporty sleduju. Nicméně program je jasný, každý den jsou tam dvě tuny zajímavých společností, které reportují svá čísla.

Bulios Black

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

V pátek 21.4. zveřejnila společnost $PG svoje čtvrtletní výsledky.

Akcie $PG rostly přibližně o 4%.

Můžete napsat jak se na výsledky $PG koukáte vy, případně jestli vás zatím zaujala nějaká jiná společnost, a třeba vás mile/nemile...

Zobrazit více

Zobrazit další komentáře

Bulios Black

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

$PG je srdcovka, které se nehodlám zbavit. Nakupuju průběžně a tam mě už krátkodobé pohyby netrápí.

Těším se na $KO. Na $META se netěším jelikož čekám problém 😀

Bulios Black

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

$GOOGL oznámil, že se chystá spustit reklamní kampaně, které budou řízeny generativní umělou inteligencí. Toto je další zbraň, kterou $GOOGL tasí do boje s $MSFT .

Tak co myslíte, pomůže to Googlu v růstu, a upevnění pozice na trhu...

Zobrazit více

Bulios Black

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

JJ ty tychnologie to je něco. Jako už přes měsíc si držím názor toho, že by trh měl spadnout aspoň tak cca o 8-10%. Chápu ten boom kolem AI, ty společnosti se předhánějí, ale není to už moc když jsou to věci jako konflikt na Ukrajině, stále vysoká inflace, zvyšování sazeb ... Já osobně teď do longu u technologi a IT nechodím, naopak, už jsem se snažil jít občas short, naštěstí teda dávám si stopky, takže ztráty jsou nízké. Co se týká těch "konzumních" (označil jsem si to tak u sebe, jelikož jejich produkty pijeme, jíme), tak to je fajn a já osobně čekám na příležitost nakoupit $PG a $SBUX ten pod 100$ bude fajn :)