Kam $AAPL , tam celý trh aneb varování pro akciové býky.

Akcie Applu v úterý, tedy v den představení nových zařízení v čele s iPhonem 15, ztratily 1,71 %. Z historického maxima z 1. srpna stále odepisují přes 10 %, a jsou tak ve fázi korekce. Investoři, kteří vkládají peníze plošně do indexu S&P 500, by jistě rádi od největší veřejně obchodované firmy viděli na burze lepší...

Zobrazit více

Feed

Bulios Black

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Čína údajně nevydala žádné zákony ani pravidla, která by zakazovala používání iPhonů nebo jiných zahraničních značek telefonů, uvedl mluvčí čínské vlády. Tak teď kde je pravda? 😅

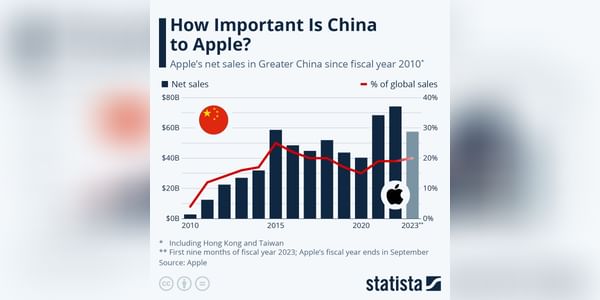

...Jak ukazuje následující graf, Čína je pro Apple $AAPL velmi důležitým trhem, který představuje zhruba 20 procent celkových tržeb společnosti.

Zobrazit další komentáře

Pravda nejspis bude nekde uprostred;) btw pokud by Cina uzakonila, ze zadny z jejich statnich zamestnancu si nekoupi/nedostane iPhone, tak je to cca 60mio ks, ktere jim Cina nevyrobi.

Bulios Black

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Jak hodnotíte včerejší Apple Event $AAPL?

Celkem překvapivé bylo to, že nový iPhone 15 Pro bude začínat za stejnou cenu jako v loňském roce ($999).

Zobrazit více

Zobrazit další komentáře

Bulios Black

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Asi budu v opozici. Spousta lidí neustále kritizuje, že kde je nějaká změna a nástupce? Na otázku co by se mělo změnit a jak by měl vypadat ten nástupce iPhone a co jim vlastně chybí, pokrčí rameny. Maximálně někdo zmíní skládací telefon, což je za mně z mechanického hlediska hloupost.

Za mně nové iPhony super. Hlavní změny pod kapotou. Ono se řekne, hmm je to "jen" o něco rychlejší, lepší foťák to je toho, ale ten development za tím je naprosto neskutečný. Z pohledu akcií je to pro mně ta iterace která donutí to spoustu lidí koupit. Spoustu lidí s iPhone X,XS, 11,12 reálně nemělo důvod přecházet a tohle pro ně bude nástupce.

Zároveň Apple jasně naznačuje, že se chce soustředit na podporu her. Jak už se psalo níže, AAA herní studio vydává hru na PS5, PC a wait for it ... iPhone. To je přece naprosto neuvěřitelné. Pokud Apple zařídí, aby Macbookách byla dostupná většina nových her a že bude možné si koupit AppleTV, Macbook jako herní zařízení tak je to naprosto nový trh a spoustu nových uživatelů, kteří by jinak o Applu neuvažovali.

Bulios Black

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Vaše hodnocení dnešního $AAPL eventu?

Jsem jediný, komu přijde, že Applu dochází pára?

Zobrazit další komentáře

Shrnutí:

- AW jsou Carbon neutral

- Zavedli jsme USB-C takže nyní můžete každé zařízení napájet jiným kabelem - paráda.

- Opletli jsme kabel textilem - wow!

- Pokud jste si koupili iPhone 14Pro, tak jste debilové, protože letos dáme dynic island všem bez příplatku.

- No a trochu jsme vylepšili display.

Málo? Sakra! Počkejte… eeehm! Jooo!

- iPhony jsme obalili do titanu! A titan se používal u Mars roveru, takže je to hustý!

To je za mě letošní Keynote ve zkratce a divím se, že akcie nesletěly ještě víc.

Všeobecně se očekává, že společnost Apple $AAPL v úterý na své akci „Wonderlust“ představí nový iPhone, a pokud je historie nějakým vodítkem, možná není vhodnější doba na to, abyste zvážili nákup akcií.

Podle analytika Erika Woodringa z Morgan Stanley mají akcie společnosti Apple šest měsíců po uvedení iPhonu na trh tendenci dosahovat lepších výsledků, ale během jednoho až tří...

Zobrazit více

Zobrazit další komentáře

Bulios Black

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Díky za přehled. Já se jako každý rok na představení nových modelů těším a budu konferenci sledovat. Myslím, že by to mohlo trochu povzbudit akcie Applu po tom minulém týdnu. Momentálně neví kam se mají pohnou a už mě to docela irituje...😅

Apple 🍎

Zdravím Investoři, zítra 12.09.2023 v 19:00 nás čeká $AAPL event. Co očekáváte? Jaké máte pocity?

Očekáváte nějaký kvalitní nové kousky, či nějakou nudu? Dejte mi určitě vědět. 👍🏽

Já osobně očekávám to, že nový iPhone opět bude velká pecka! Ale myslím si že to nebude nic jakože až moc obrovského. Každopádně na nové produkty se těším, jelikož Apple vlastním a mám ho rád.

Jak...

Zobrazit více

Zobrazit další komentáře

Bulios Black

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Já jsme na tom velmi podobně. Jsme dlouholetý uživatel a akcionář. Na eventy se vždycky těším a poctivě sleduji👍

Bulios Black

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Akcie společnosti $QCOM rostou po oznámení dodávání 5G čipů do iPhonů o více než 4%.

Čipy budou společnosti $AAPL dodávat do roku 2026.

Zobrazit více

Zobrazit další komentáře

Bulios Black

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Zpráva je to super a společnost vypadá zajímavě. Ovšem společnost moc nesleduji a moc jí neznám, ovšem asi se na ní kouknu podrobněji :)

Bulios Black

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Investoři, jakou akcii jste držely, držíte, nebo máte v plánu držet nejdéle v portfoliu?

Já ve svém portfoliu nejdéle držím akcie $AAPL a mám je v plánu držet i několik dalších let až desítek let. Tato společnost je super a ten byznys je neskutečný. Akcie $AAPL se v posledních dnech propadly o pár % a společnost za pár dní ztratila přibižně 200 mld. USD ze své tržní kapitalizace...

Zobrazit více

China 🇨🇳

Investoři, jak momentálně vnímáte situace, které se momentálně dějí v Číně? Začínající deflace, ekonomika na tom není vůbec dobře .. + Ty zákazy iPhonů, což je velká ztráta pro $AAPL.

Já osobně mám rád společnost $NIO a rád do ní investuji, ale momentálně si tím vůbec nejsem jistý, zda-li to je vůbec dobrý nápad. Od mého posledního nákupu se $NIO propadla o nějakých 12%...

Zobrazit více

Zobrazit další komentáře

Pozrite sa na akých hodnotách sa obchodujú Čínske spoločnosti a potom sa pozrite napríklad na tie Americké. Myslím, že v Číne je zarátaná už veľká časť rizika, či už politického alebo eknomického, pritom veľa spoločnosti vypláca aj dividendu. Biznis je biznis a žijeme v dobe, keď sú peniaze až na prvom mieste :) Malá časť portfólia v Číne/Ázii môže byť v budúcnosti príjemným prekvapením. Veľa šťastia.

Bulios Black

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

📌 Rychlý update k nedávnému poklesu akcií $AAPL 📉

- Společnost včera odepisovala dalších 5 %, trh zahájil obchodování s gapem přes 4,2 %. Obchodování nakonec bylo ukončeno s růstem + 1,4 %.

- Za dva dny od oznámení zákazu používání mobilních telefonů ve státních podnicích v Číně přišla společnost o tržní kapitalizaci ve výši přibližně 190 miliard USD. I přesto je Apple stále...

Zobrazit více

Bulios Black

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Velkým technologickým firmám "hrozí" Evropská Unie + Apple má teď problémy v Číně.

Společnosti Amazon $AMZN , Alphabet $GOOG , Apple $AAPL , Microsoft $MSFT , Meta $META a ByteDance (je čínská společnost zabývající se internetovými technologiemi), mají nyní šest měsíců na to, aby vyhověly přísnějším pravidlům trhu.

Zobrazit více

Zobrazit další komentáře

Bulios Black

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Moc to nechápu a strašně mě toto ( slušně řečeno) štve. Jakmile nějaký stát, nebo v tomto případě EU potřebuje peníze, tak jde po společnostech kterým se daří. Štve mě, že když nějaký stát, nebo EU potřebují peníze a mají obrovský dluh, tak se zaměří na tyto společnosti. Jinak o Apple se nebojím. Apple bude stavět a asi už staví továrny v Indii a bude se zaměřovat na tu Indii, takže tam nevidím problém.

Bulios Black

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Máme tady další den a další výprodej. Data o nezaměstnanosti dopadla dobře -takže špatně pro trhy a $AAPL se otevře o 3,8 % níže, než včera uzavřel. Za 2 dny je to pohyb o 7,3 % a to už nejde přehlédnout. Kde se to zastaví?

Zobrazit další komentáře

To už je celkem zajímavý drop... očividně férová cena už začíná úřadovat :)

Bulios Black

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

❌ $AAPL zakázán v Číně 🇨🇳

- Akcie společnosti Apple se včera propadly o 3,6 %. Reagovaly na informace, týkající se vládních úředníků v Číně, kterým bylo zakázáno v práci nosit či používat mobilní telefony od Applu. Čína tak pravděpodobně reaguje na omezení ze strany USA, které se vztahuje k TikToku nebo výrobci Huawei, kteří mají naopak v USA zákaz. ✅

- Apple na čínském trhu s...

Zobrazit více

Bulios Black

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Evropská komise označila šest velkých technologických společností za "gatekeepers” digitální ekonomiky. To znamená, že budou podléhat výrazně přísnějším pravidlům, což může jednak snížit příjmy, oblibu tak dosahy.

Tento krok je součástí zákona o digitálních trzích (DMA), průkopnického zákona, který přizpůsobuje dlouhodobé principy politiky hospodářské soutěže nové realitě 21....

Zobrazit více

Zobrazit další komentáře

Bulios Black

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Já tohle na jednu stranu chápu, ale na druhou mi to neskutečně vadí. Asi by se mi taky nelíbilo, kdybych budoval firmu a díky tomu, že jsem úspěšný mi teď budou lézt do zelí.

ARM HOLDINGS se chystá na velkolepou primární nabídku akcií, která prověří zájem trhu o významnou technologickou společnost. Její cílové ocenění však naznačuje, že se smiřuje s tím, že nebude další Nvidií.

Podle listu The Wall Street Journal, který se odvolává na osoby obeznámené s touto záležitostí, britský výrobce čipů Arm usiluje o ocenění své primární nabídky akcií na burze...

Zobrazit více

Zobrazit další komentáře

Bulios Black

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

tato společnost mě velice zaujala, ale nějak jsem na ní zapomněl a tím pádem děkuji za připomenutí. Na společnost se budu muset rychle podívat a to IPO budu určitě aspoň trochu sledovat :)

Bulios Black

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Je sice pravda, že společnosti se posledních pár dní moc nedaří, ovšem myslím že to dlouho trvat nebude a za pár dní vše bude jako předtím a nebo to bude ještě lepší :)